itad bir|Double Tax Agreements : Bacolod Registration of Book of Accounts. Application for Authority to Print Receipts & Invoices. .

Surgeon Dr Eric Garcia murdered by Sean Cody porn star Jordan Joplin. A Washington man was sentenced to 99 years in prison for the poisoning murder of a prominent gay surgeon in Alaska on April 9, .

itad bir,2021 Revenue Delegation of Authority Orders. 2020 Revenue Delegation of Authority .2020 Revenue Memorandum Circulars. Previous Years. Revenue Delegation .Registration of Book of Accounts. Application for Authority to Print .

itad birDouble Tax Agreements - 2021 ITAD BIR Rulings - Bureau of Internal Revenue

2020 Revenue Memorandum Circulars. Previous Years. Revenue Delegation Authority .

Registration of Book of Accounts. Application for Authority to Print Receipts & Invoices. .

The Philippine Bureau of Internal Revenue (BIR) issued Revenue .itad bir Double Tax Agreements Tax Alert No. 28 | PwC Philippines. Tax Alert No. 28 [Revenue .

It also explains that the International Tax Affairs Division (ITAD), along with its EOI . In Revenue Memorandum Order (RMO) No. 14-2021, the BIR provided that .

Double Tax Agreements. Revenue Issuances. Revenue Regulations. 2024 .

The BIR's International Tax Affairs Division (ITAD), through its EOI .

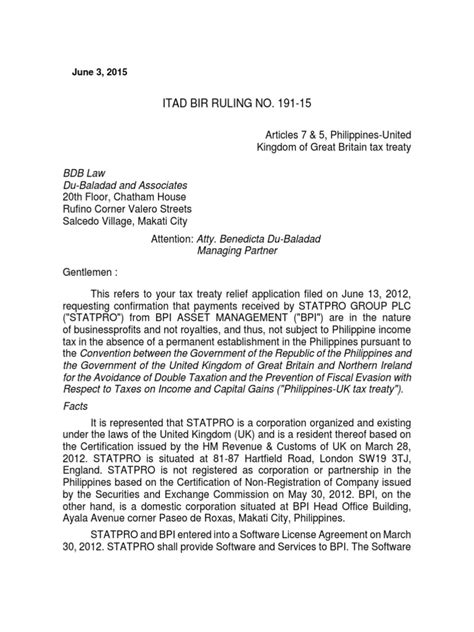

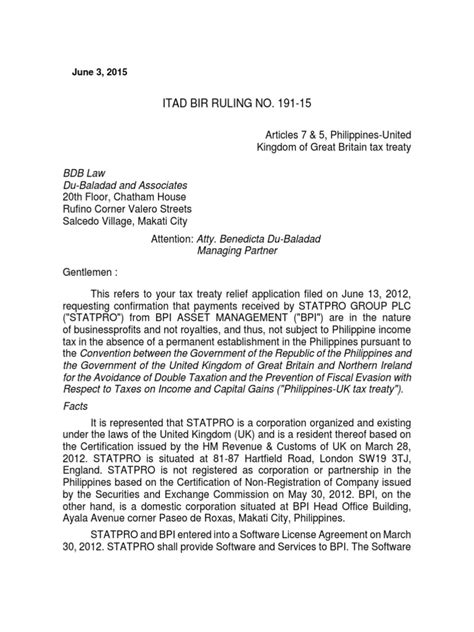

(ITAD BIR Ruling No. 002-16, 26 February 2016) Interest on foreign loan paid by a .Prepares all pleadings, briefs and memoranda to be filed with the Court of Tax Appeals, RTC, and other courts and administrative agencies in connection with internal revenue cases pending before the same. Office Address. .Double Tax Agreements Taxpayers who fail to secure a TRC shall not be allowed to claim foreign tax credits in excess of the appropriate amount of tax that is supposed to be paid in the source state had the income recipient invoked the provision/s of the treaty and proved his/her/its residency in the Philippines (Section 5, Revenue Memorandum Order No. 43-2020).Revenue Memorandum Circulars. 2024 Revenue Memorandum Circulars. 2023 Revenue Memorandum Circulars. 2022 Revenue Memorandum Circulars. 2021 Revenue Memorandum Circulars. 2020 Revenue Memorandum Circulars. Previous Years. Revenue Delegation Authority Orders. 2024 Revenue Delegation of Authority Orders.

2022 DA ITAD BIR Rulings; 2016 DA ITAD BIR Rulings; 2021 ITAD BIR Rulings; 2021 DA ITAD BIR Rulings; Republic of the Philippines. All content is in the public domain unless otherwise stated. About GOVPH. Learn more about the Philippine government, its structure, how government works and the people behind it.2020 DA ITAD BIR Rulings. 2019 DA ITAD BIR Rulings. 2018 DA ITAD BIR Rulings. 2017 DA ITAD BIR Rulings. 2016 DA ITAD BIR Rulings. Taxation of Non-Residents. Taxation of Foreign Source Income. Taxation of Resident Foreign Missions and International Organizations. Exchange of Information Program.2023 BIR Rulings. Revenue Issuances. Revenue Regulations. 2024 Revenue Regulations. 2023 Revenue Regulations. 2022 Revenue Regulations. 2021 Revenue Regulations. 2020 Revenue Regulations. Previous Years.This form, together with all the necessary documents, shall be submitted every time a tax treaty application or request for confirmation is filed with the International Tax Affairs Division (ITAD) of the Bureau of Internal Revenue. BIR Form No. 1914. Download. (PDF) Application for Tax Credits/Refunds.Registration of Book of Accounts. Application for Authority to Print Receipts & Invoices. Application for Authority to Use Computerized Accounting Systems. Application for Permit to Use CRM and/or POS. Legal Matters. Law and Legislative Rulings. 2024 BIR Rulings. 2023 BIR Rulings. 2022 BIR Rulings.We would like to show you a description here but the site won’t allow us.

ITAD BIR Ruling No. 040-19. Republic of the Philippines. All content is in the public domain unless otherwise stated. About GOVPH. Learn more about the Philippine government, its structure, how government works and the people behind it. GOV.PH; Open Data Portal; Official Gazette; Government Links.

The Foreign Account Tax Compliance Act (FATCA) was enacted by the United States Congress in March 2010 to improve compliance with US tax laws. FATCA imposes certain due diligence and reporting obligations on foreign (non-US) financial institutions, including Philippines institutions. These institutions will be required to report to the US .

20%. 6. Share of a non-resident alien individual in the distributable net income after tax of a partnership (except GPPs) of which he is a partner or from an association, a joint account, a joint venture or consortium taxable as corporation of which he .Contact Us. BIR Trunkline. Taxpayers with tax queries and concerns may call the Customer Assistance Division (formerly BIR Contact Center) at. Hotline No. 8538-3200 or send an email to [email protected]. BIR National Office Bldg., BIR Road, Diliman, Quezon City, Philippines. National Office Trunkline: (02) 8981-7000.

برنامج التدبير المعلوماتي للإدارة التربوية.. أول برنامج احترافي خاص بأطر الإدارة التربوية، يقوم بإنجاز جميع المهام الضرورية خلال السنة الدراسية، بصفة تلقائية وبأقل وقت وأقل مجهود، بتوافق تام مع البرامج الرسمية .2019 DA ITAD BIR Rulings. 2018 DA ITAD BIR Rulings. 2017 DA ITAD BIR Rulings. 2016 DA ITAD BIR Rulings. Taxation of Non-Residents. Taxation of Foreign Source Income. Taxation of Resident Foreign Missions and International Organizations. Exchange of Information Program. FATCA.2020 DA ITAD BIR Rulings. 2019 DA ITAD BIR Rulings. 2018 DA ITAD BIR Rulings. 2017 DA ITAD BIR Rulings. 2016 DA ITAD BIR Rulings. Taxation of Non-Residents. Taxation of Foreign Source Income. Taxation of Resident Foreign Missions and International Organizations. Exchange of Information Program.2021 DA ITAD BIR Rulings. Revenue Issuances. Revenue Regulations. 2024 Revenue Regulations. 2023 Revenue Regulations. 2022 Revenue Regulations. 2021 Revenue Regulations. 2020 Revenue Regulations. Previous Years.2015 Revenue Delegation of Authority Orders. 2014 Revenue Delegation of Authority Orders. 2013 Revenue Delegation of Authority Orders. 2012 Revenue Delagation of Authority Orders. 2011 Revenue Delegation of Authority Orders. 2010 Revenue Delegation of Authority Orders. Revenue Administrative Orders:

itad bir|Double Tax Agreements

PH0 · Tax brief

PH1 · Tax Alert No. 28

PH2 · Request for BIR confirmation due in April

PH3 · Philippines streamlines process for claiming tax treaty benefits

PH4 · Double Tax Agreements

PH5 · BIR provides new guidelines and procedures for exchange in

PH6 · BIR issues regulation on spontaneous exchange of taxpayer

PH7 · 2022 ITAD BIR Rulings

PH8 · 2021 ITAD BIR Rulings

PH9 · 2020 ITAD BIR Rulings